What is Audit Sampling?

ISA 530 (audit sampling) defines audit sampling as “the application of audit procedures to less than 100% of items within a population of audit relevance such that all sampling units have a chance of selection in order to provide the auditor with a reasonable basis on which to draw conclusions about the entire population.”

That means sampling in audit is applying procedures/tests to a number of items of a group from which a conclusion about the whole group can be formed. In practice, the auditor cannot check each and every transaction of the client as it could take years in some cases and would be uneconomical to do so. Therefore, auditors rely on applying sampling techniques to conclude their report.

Let me give you a real-life example of sampling to make it easier for you to understand the concept.

Suppose you go to a market to buy a dozen of Oranges. Now, there are a lot of fruit sellers out there with different varieties. To make sure you buy the good ones, you’d want to check the oranges of different fruit sellers but you cannot check each and every orange due to the hundreds and thousands of stock with each seller.

What you can do is to check a few oranges offered by each seller to conclude which oranges are good enough to buy. You didn’t check all of the oranges but still, you managed to reach at the conclusion by performing the sampling. In the same way, auditors perform sampling techniques to arrive at a conclusion about an item of the financial statements.

Think about this; in some companies, thousands of transactions occur on a daily basis and they will probably have millions of transactions in a period of one year. If the auditors were to check each and every transaction, it could take them years or they will have to employ thousands of professionals to perform the task. The first one would affect the relevance of the audit report and decision-makers wouldn’t be able to act timely. The second one is extremely uneconomical and the cost would outweigh the benefit of the audit engagement.

Therefore, to complete the engagement timely and in a cost-effective way, auditors perform sampling in an audit. By checking a few hundred from thousands of transactions, they conclude a report about the rest of the population. So, what makes sampling a reliable process for auditors? what sampling techniques do they use? Let’s find out.

Sampling Techniques that Auditors use

Primarily, there are two types of sampling techniques. Statistical and non-statistical sampling. In statistical sampling, each sampling unit has an equal chance of selection and the auditors check items randomly using probability theory to evaluate sample results.

The use of Non-statistical sampling in audit sampling essentially removes the probability theory and takes into consideration the auditor’s professional judgment in sampling. In both sampling techniques, the objective is to provide a reasonable basis that allows an auditor to draw valid conclusions about the overall population.

Statistical and non-statistical sampling techniques further have their own types. They are:

| Statistical Sampling | Non-statistical sampling |

|---|---|

| Random Sampling | Haphazard Sampling |

| Systematic Sampling | Block Selection |

| Monetary Unit Sampling |

In every sampling technique, you must ensure the samples you have selected represents the population. If the sample isn’t representative of the population, you won’t be able to form a conclusion of the entire population. Here is an explanation of the 5 types of sampling techniques in auditing.

1. Random Sampling

In random sampling, the auditors use random number tables or random number generators for sample picking. This way, each item has an equal chance to get selected and the result of the random sampling is extrapolated (extrapolation is extending the application of a method to an unknown situation by assuming that existing trends will continue) to the overall population to form a conclusion.

Let’s say a company has made a thousand credit sales in a period. Checking all those 1000 invoices would be time-consuming and the auditor may choose to check 10% of the invoices. To do so, they could use a simple random number generator. Let me show you how it works.

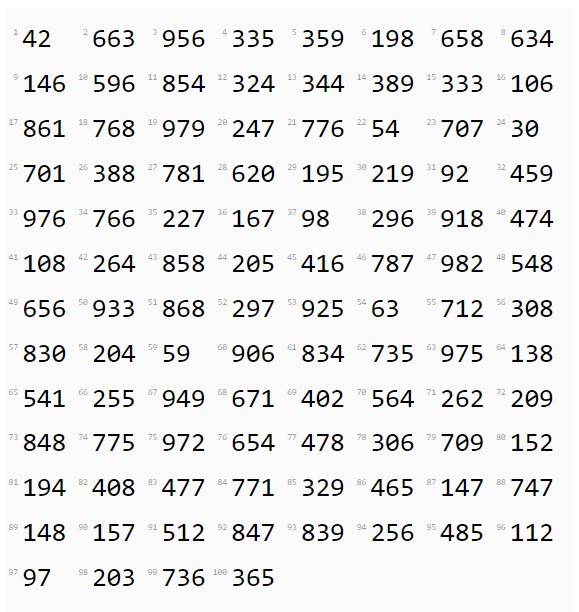

This random number generator will generate 100 random numbers (10% of 1000) that auditors can check. The next step is to extrapolate the results of the 10% to the whole population of the invoices. In our case, the numbers are as follows.

As you can see, there is no pattern or sequence in the numbers and every number will have an equal chance of selection in random sampling. The auditor can use different types of calculators that are available on the web or use a customized table or generator for the audit engagement.

2. Systematic Selection

The starting point in systematic selection is picked randomly using a random number generator but what makes it different from random sampling is the fixed/periodic interval. For example, a company has 20,000 total invoices and this year’s first invoice starts from the number 10,000. So, we have 10,000 total invoices for the year and the sample size (the number of samples to be checked) is set at 50.

Let’s say using the random number calculator, the starting point is 103. That means, we will start from invoice # 10,103(10,000+103) and check every 50th invoice until we check 50 invoices in total. The next numbers will be 10,153, 10,203, 10,253, and so on…

3. Monetary Unit Sampling

Monetary unit sampling (MUS) is an auditor’s favorite sampling technique. Why? Well, it focuses on the individual dollar and not the number of accounts. In MUS, transactions with higher balances have higher chances of selection, and the fact that auditors are interested in material misstatements rather than “missing pennies” makes it a more suitable sampling technique for the audit engagement.

That being said, it’s a value-weighted selection in which sample sizes, selections, and evaluations are decided considering the monetary value of subject areas.

One way to perform MUS is;

Let’s say a company has 1,000 receivables in total expected from 5 different customers. Money owed by each customer is as follows.

| Customer | Amount |

|---|---|

| A | $500 |

| B | $40 |

| C | $150 |

| D | $60 |

| E | $250 |

Using the MUS, a sample unit will be assigned to each dollar of the receivable balance. In our example, Customer A has 500 sample units with a percentage of 50 (500/1000*100). That means, customer A is a significant receivable of the company and will have material misstatements. Therefore, auditors will be more likely to pick customer A for sampling purposes.

On the other hand, customer B has comparatively a minor account of $40 and will have lower probability for “sample picking”.

4. Haphazard Sampling

A non-statistical sampling method, haphazard sampling has no definite structure. Using this technique, the auditor fully relies on their professional judgment and experience. While selecting samples in haphazard sampling, the auditor will pick the ones they think is worth picking or where they expect misstatements.

It’s not commonly used due to the following factors:

- The objective of sampling is to ensure all items that make up the population gets an equal chance of selection. Haphazard sampling ignores that.

- The auditor can deliberately avoid selecting items that are difficult to identify or complicated to test.

- It has an inherent risk of biasness.

5. Block Selection

This type of sampling involves selecting items for sampling which share a common border within a population. This non-statistical sampling method is also not a very common sampling technique among auditors as it’s difficult to select a block that represents the whole of the population.

An example of Block Selection would be checking invoices issued in march for misstatements. Invoices of the remaining 11 months would be skipped as they don’t belong to the “block”. Picking invoices of a month clearly isn’t a wise strategy as it isn’t a good representation of the whole population/year.

However, with a bit of improvisation, this strategy could be helpful. If the blocks are selected from different areas of the population, each audit area will be tested and that will make more sense. In the above example, the auditor could make three blocks instead of one, keeping the same overall sample size. This way, the sampling risk will be minimized, which leads us to our next important element of audit sampling.

How does Sampling Risk arise in Audit?

Sampling risk is a risk that the auditor’s conclusions based on samples may be different from the conclusion if the procedures were performed on the entire population. That means, the samples may not represent the entire population and extrapolating the samples would lead to an incorrect conclusion.

The sampling risk will lead the auditor to forming an incorrect audit opinion in one of the two ways;

- By testing a few samples, the auditor will conclude the fairness of the entire process when in fact it isn’t.

- Or, the auditor concludes material misstatements by extrapolating the results of the sample checks throughout the population when in fact only the samples were misstated.

These types of erroneous conclusions can be formed by applying sampling techniques and it’s one of the limitations of performing procedures on sampling basis.

Pros & Cons

Sampling has a number of pros and limitations but due to the lack of resources, time, and no alternative method, it’s applied in almost every audit engagement. Here are the pros and cons of using sampling techniques in audits.

Pros

- It saves time, money, and human resource.

- If picked wisely, the samples could represent the whole population and the auditors will achieve their objective by performing sample checks.

Cons

- The samples may not represent the whole population and will lead auditors to form an erroneous conclusion leading to an inappropriate audit opinion.

- Difficult to select samples that represent the whole group.

- Can be costly at times, especially when external experts are hired to perform the task.