Ask any day trader about their favorite trading pair and there’s a fat chance that they will mention the Volatility 75 Index AKA the VIX 75 index.

Since it’s a purely technical index and does not have any fundamentals, there are a lot of questions that many of you are curious about. I’ve been trading the Volatility 75 index for over 3 years now and tried trading it on different trading platforms. Consequently, I have collected helpful information about the volatility 75 index that every volatility enthusiast must know.

Specifically, I will start with answering the most frequently asked questions on the web regarding the volatility 75 index. Here are some vix75 questions along with answers:

How to Add the Volatility 75 Index to Trading View?

As you might already know, the volatility 75 index is not available on the default trading view website. If you navigate to Trading View and search for the volatility 75 index, you won’t find the pair. Many volatility 75 index traders only browse the chart with their phones using mt4 or mt5. Never do that..!

Here’s how you can find the volatility 75 index chart on your desktop:

Open your browser and type “Trading View Deriv“. Open the first link or directly access the Deriv Trading View by clicking this link.

Previously Binary Trading View, the Deriv Trading View has Boom & Crash, Volatility, and other synthetic indices charts. Please note that you won’t be able to access the old version since it’s now moved to this new one.

To find the volatility 75 index chart on Trading View, type “r_75” in the search bar highlighted in the following image:

It’s important to understand that if you search “volatility” or “vix”, you won’t find any pair and you can only find the volatility 75 index chart by searching for “r_75”.

Here’s how the volatility 75 charts looks like on the Deriv Trading View platform:

It’s better than the previous version and you can browse the vix75 index chart smoothly without any lag. You can use all features of the conventional trading view and you should definitely analyze the volatility 75 index using this desktop chart.

Where Can I trade the Volatility 75 Index?

The fact that the volatility 75 index is a synthetic index and does not follow the rules of technical analysis, only a specific group of traders trade this pair. Therefore, not every broker offers the volatility 75.

Though highly specialized, it’s still offered by a various brokers and you can trade the volatility 75 index anywhere in the world.

Here’s the list of some prominent brokers who offer the Volatility 75 Index:

1. Deriv.com

Deriv has been providing reliable brokerage services for over 25 years now. It’s one of my favorite brokers when it comes to the volatility 75 index. The low spread and commissions ensure you can trade with lower risks and you won’t have to give away a fair share of your profits to the broker.

Apart from the volatility 75 index, Deriv also offers the boom & crash indices and other synthetic indices including step indices, jump indices, and even other volatility pairs like volatility 25 and volatility 50.

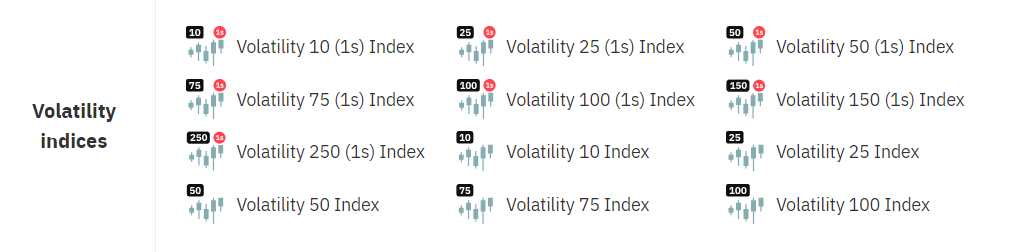

The full list of volatility indices that Deriv offers are as follows.

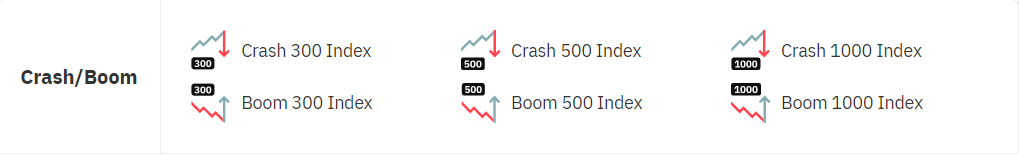

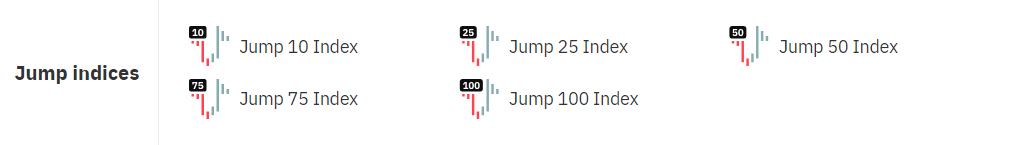

Th Boom & Crash and Jump indices offered by Deriv.com include:

Visit the official site of Deriv.com for more information about the volatility75 index.

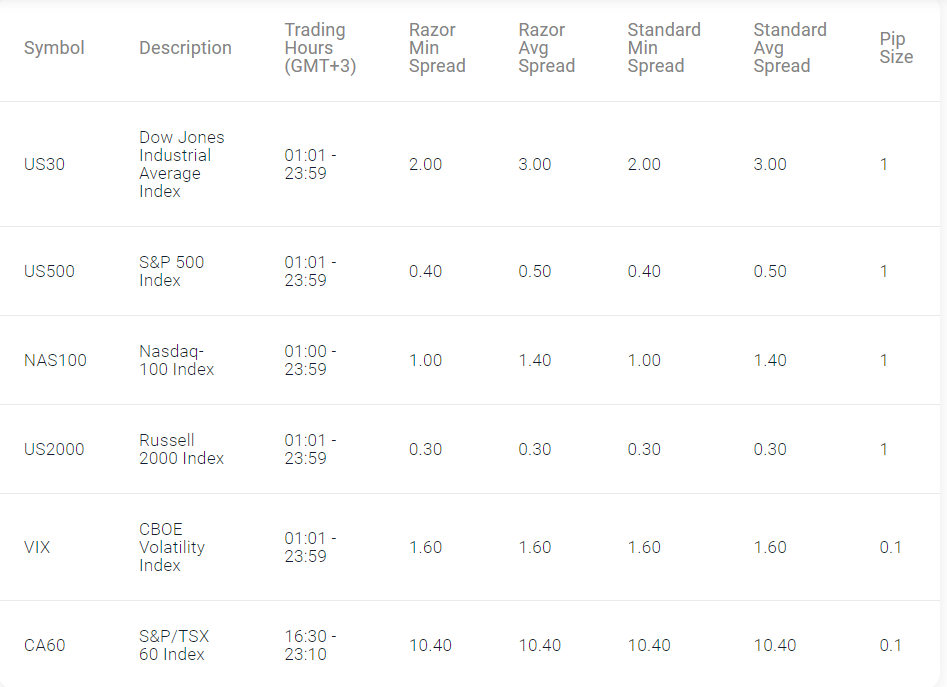

2. PepperStone

Next on my list of the best brokers for volatility 75 index is PepperStone. It is yet another reliable broker with extensive trading channels and offers more than 60 currency pairs alongside 1200+ CFDs across different assets.

Though the spread is a little more than Deriv.com, it’s still a great option due to the fact that you can trade an extensive list of currencies, indices, and other CFDs.

Unlike Deriv.com, PepperStone does not offer each and every synthetic index and you can only trade selective synthetic indices including the volatility 75 index.

Other Brokers that offer Volatility 75 Index

Here is the list of some other brokers to consider for trading the volatility 75 and other volatility indices:

It’s advisable to perform a thorough and in-depth research before choosing your broker for the volatility 75 index since each broker offers varying spreads and trading pairs. Choose the one that offers low spread and charge less in commissions.

Does Exness have Volatility 75 Index?

Exness is yet another trusted platform to trade forex and currency pairs. If you’re using Exness or considering Exness, you should know that Exness does not offer Volatility 75 Index. It also does not offer other variations of the volatility 75 index including vix25 and vix50. Therefore, you should not consider Exness if you plan to trade the volatility 75 index.

How to add Volatility 75 Index on MT4?

It’s pretty straightforward to add volatility75 index on mt4. Simply open your mt4 and open the window showing your current trading pairs. Click on the “+” or “Add a chart” button on top of the screen and search for volatility 75. If you can find the volatility 75 chart, simply add it to the list and you’re good to go!

Some of you may not see the volatility 75 in results. It’s because your broker does not offer it. If you want to trade the volatility 75 index, you can choose one of the above brokers.

Adding Volatility 75 on MT4 (Mobile Version)

Whether you’re using the mt4 on desktop or mobile, the technique to add the volatility75 index is the same. On your mobile mt4, go to charts>add a new pair>search volatility 75 or vix75>add to charts and the volatility 75 index chart will be automatically added to your available pairs. If you are unable to find the volatility75 index pair, the reason, as explained above, is because the broker does not offer it.

How to Calculate Pips on Volatility 75 Index?

Whenever someone starts trading the volatility 75 index, this is first thing that comes to mind. Calculating pips of the volatility75 index can be complicated. Specifically, it is the robust moment of the pair that confuses many. It can move thousands of points and that’s what confuses traders in calculating pips for the volatility 75 index. Do not apply rules of thumbs and do not guess!

Here’s how you can calculate the pips for the volatility 75 index:

The pip value in volatility 75 index can be calculated by understanding 3 variables

- Volume: It’s the lot size that you use on the volatility 75 index. For example, 0.001 or 008 etc. The minimum lot size for volatility 75 index is 0.001 and maximum lot size is 1.

- Contract Size: This is defined by the broker that you use. Different brokers have different contract sizes for volatility 75 index.

- And Point Value: Point Value is simply the movement in the volatility 75 points. For example, if the price of volatility 75 moves from 362.500 to 362.700, we can say that there’s a movement of 2 points in the pair.

Now coming to our original question: How do you exactly calculate pips in volatility 75 index? Here’s a simple formula that you can use to calculate pips in volatility 75 index:

VIX75 Pips= Volume * Contract Size * Point ValueExplanation

When you multiply the volume with contract size and point value, you get the pip value for VIX75 Index. Say the volume is 1, contract size is 1, and the point value is 0.01, then applying the formula we get;

Volatility 75 Pip= 0.01 (1*1*0.01)

What Affects the Volatility 75 Index?

If you’ve ever been a witness of the brutal volatility 75 movement, you must have thought about it.

Where does the movement come from? What causes the sudden upward and downward swing in the volatility 75 index? If there are no fundamental news reports or speeches involved, how the hell then it never stop moving? Here’s how:

See, the volatility 75 index is different from synthetic indices and it’s not simply a computer generated number pattern. In fact, it’s a financial instrument and measures the market’s expectation of volatility in the next 30 days. Basically, it indicates fear or uncertainty in the market and will follow an upward pattern when investor fear is high and vice versa.

The volatility 75 index is analyzed by forex traders and due to it’s popularity, it can also be traded in isolation.

So here is the answer to the question “How does the volatility 75 index work?”..!

The volatility 75 index is driven by market fear. Higher risk will result in increased price of volatility 75 index and lower risk would mean declining price of the volatility 75 index. However, the fact that risk itself is subjective and one event that might be considered a risk for a wider range of investor may prove to be beneficial for a lot of investors out there, is the reason why trading the volatility 75 index could be a bit tricky.

Therefore, always perform a thorough research before trading this highly volatile index and do not simply believe the general market expectation with your eyes closed.