There are many techniques & formulas to calculate and analyze the financial viability of a project or product. One such technique is the return on capital employed which is also known as the accounting rate of return.

What Is Return On Capital Employed (ROCE)?

Return on Capital Employed or ROCE is a financial ratio that measures the financial viability of a project by comparing its monetary returns with the capital that the project requires. Specifically, the ratio tells us whether the project should be accepted on the basis of its financial returns.

The ROCE considers the money that has been put into the project to decide whether it is a good idea to go with the project. It basically considers the equity & gearing level of the company.

For example: if a project requires a $2000 investment and its yearly return is estimated to be $300 then we will compare the return of $300 with the capital employed, which is $1000 to arrive at ROCE. Here’s how we can simply calculate the return on capital employed ratio…

Calculation Of Return On Capital Employed

The return on capital employed ratio can be calculated by using the following TWO methods.

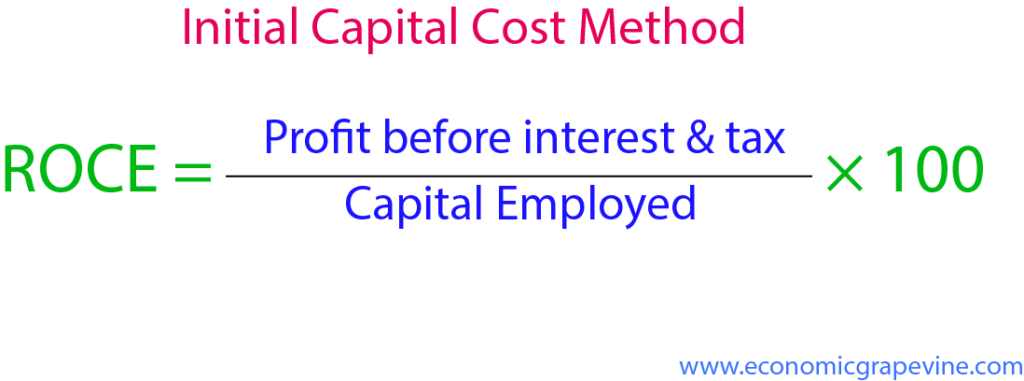

- Initial Capital Cost method

- Average Capital Investment method

Using the initial capital cost method, we can calculate the ROCE as follows:

ROCE = Profit before interest & tax / capital employed * 100

- In ROCE calculation, you should consider the operating profit figure only, that is profit before interests and taxes paid.

- To arrive at the capital employed figure, deduct current liabilities from total assets. If you are preparing for an exam, this figure will normally be given in the exam.

Using the Average Capital Investment method, the ROCE can be calculated as:

ROCE = Profit before interest & tax / Average Capital Investment * 100

Whereas,

Average capital investment = Initial Investment + Scrap Value / 2

Normally, the first method (Initial Capital Cost Method) is used unless you are specifically asked to calculate ROCE using the average investment method.

Why ROCE Is Calculated?

Return on Capital Employed is calculated to analyze how viable a project or product is in terms of its profitability or return. The ratio is then compared with benchmarks like the target return of the company, industry average, and competitors’ ROCE to decide whether it is a good idea to proceed with the project.

Normally, if the ROCE is greater than the benchmark, it is considered positive and the project is accepted. If the ROCE does not meet the acceptance criteria ie when it is not equal to or greater than the target rate or hurdle rate, the project or product is rejected.

Differences Between ROCE & Payback

ROCE is sometimes associated with the payback period but they both are different. While the ROCE measures a project’s/product’s profitability in terms of the capital invested in it, the payback period is a method that calculates how much time it will take to recover the initial investment of a project or product.

Furthermore, the return on capital employed considers annual profit whereas the payback period considers cash inflows only.

Q: A project requires a $1000 investment and will earn the company $250 operating profit annually. Calculate its return on capital employed ratio and payback period.

ROCE = 250/1000*100= 25%

To calculate the payback period of the project, here’s a simple formula.

Payback period = Initial Investment/Annual Cash Inflow

1000/250 = 4

That means it will take the company 4 years to recover its initial investment in the project.

Like every other financial and non-financial ratio, the ROCE has its pros & cons. Below are the advantages and disadvantages of using the return on capital employed ratio.

Advantages of ROCE

- It focuses on the return on equity & debt and the project is undertaken only if the return is greater than the target return. This way, the company would select projects with sufficient return rates and would be able to easily pay off its interest costs out of the project.

- It is simple to calculate and does not require advanced accounting or mathematical skills.

- It is understandable by people of all backgrounds since it simply focuses on profitability in relation to equity & debt.

Disadvantages of ROCE

- ROCE ignores a project’s life and will mislead managers. For example, if a company has to go for ONE out of TWO projects and each of the projects requires a $1000 initial investment.

Project A will give a return of $500 for 2 years and project B will give a return of 400 for 4 years. The company will choose project A using the ROCE since its annual profit is greater than project B and will ignore the long-term aspect of project B. - It does not consider cashflows and focuses on profitability only. Nor does it consider the timing of cashflows and the company could get into cashflow difficulties.

- It does not measure absolute gain.

- There is no definitive investment signal.