Let me start with a question. Do you regret your recent stop-loss? Did the market just stop you from trade and fly toward your TP? If you are a trader, I bet you have had these experiences. It’s called Stop-Loss Hunting and it is a real thing in the market.

I hear a lot of traders complaining about manipulation of the market and how it hits their stop-loss just to reverse back. I don’t find it surprising because I’ve had the same issue for years since I first started trading. Stop-Loss hunting is probably the worst nightmare of the majority of traders and every trader must learn to avoid it in order to be profitable.

So, how do you avoid Stop-Loss Hunting? Just remove your stop-loss and you will never be hunted by the whales. NEVER DO THAT!!

Like every other trading problem, there are solutions that help you avoid stop-loss hunting. This article focuses on ways to avoid stop-loss hunting and ultimately become the PRO MAX of the market.

Disclaimer: Trading Futures, Forex, CFDs, and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results. Articles and content on this website are for educational purposes only and do not constitute investment recommendations or advice.

The Mechanism Behind Stop-Loss Hunting

It is important that you understand why Stop-Loss Hunting occurs in the first place. Spoiler: It is not a manipulation of any kind.

As you already might know that trading is a zero-sum game and for every winner out there, there sits a loser with the same trading capital. Let’s say there are buyers with $50m capital in the market and sellers with $40m capital. A bank with $30m capital wants to enter as a seller but the liquidity available is only $10m. That being said, the bank needs an extra $20m in liquidity to be able to enter the market.

To generate liquidity in the market, the bank must kick out some sellers. To do that, it needs to push the price up to an extent where it hits the stop-loss of most of the sellers out there. This phenomenon is known as stop-loss hunting.

Stop-Loss Hunting affects retail traders like you and me and it is extremely important to know how not to let stop-loss hunting eat your equity.

How To Avoid Stop-Loss Hunting?

To avoid stop-loss hunting, you need to be patient with your entry & exit points. There will be situations in the market where you will have to wait for hours or days to take your next trading position.

Here’s my list of precautions that you need to take in order to prevent the damage of stop-loss hunting. In fact, it will ultimately lead you to think like a stop-loss hunter and not a retail trader which will take your trading to next level.

1. Patience, Patience & Patience

Retail Traders are mostly day traders & scalpers. They try to seek opportunities in the market even in the worst of market conditions and treat trading as a hobby. This desire to trade no matter what leads to a poor selection of trades and ultimately huge losses in the long run.

To become a successful trader, one must learn to be patient and digest the fact that the market will always be there and you can trade as long as you have equity. The good thing about trading is that you are your own boss and you can take a day off whenever you wish to.

That being said, wait patiently for your entry points, and don’t trade just because you have to. Make your chart, identify different patterns and properly analyze the market. When you are done analyzing the market, it’s time to think like a psychologist and not a trader. Here’s how:

While the majority of retail traders lose money, you will seldom hear about the failures of big whales like banks. The reason is that trading is not a habit for them and they take every trade rationally and follow strict codes.

Furthermore, these organizations mostly look for long-term positions and will wait patiently for weeks and months if they have to. Once the market touches its desired price zone and creates liquidity (By kicking out traders), only then will they enter and take their fair share of the market. Now, here’s what you can learn from these organizations…

They can’t trade when there’s no liquidity and they are professional traders which means they would do anything to place themselves in the market. Just wait patiently for them to do their job and once you hear everyone in the group complaining about the day, you know it’s time to go big.

2. Don’t Attempt To Catch Reversals every time

If you analyze your trading history, I’m sure a lot of red trades will be those where you predicted to reverse the market in a strong trend. The phrase “The Trend Is Your Friend” is popular amongst traders for a reason and you should try to stick to it.

To attempt for reversals, you need to support your decision with strong evidence like strong price action, monthly/yearly Support & Resistance levels, higher timeframe candlestick patterns, technical patterns, etc…

The more indications you get, the higher the chances. It is just not safer to attempt reversals merely from an ordinary support level or supply zone. The Stock market is a place where anything can happen and even all-time lows and highs could get you in trouble.

That being said, avoid reversals that are not backed by strong technicals/fundamentals and you will be much safer from stop-loss hunters.

3. Avoid Placing Your Stop-Loss Too Close

Where do you mostly place your stop-loss? Right below the support level/Demand zone or above the Resistance Level/Supply Zone right? How often does it work? Once in a Blue Moon!!

Support & Resistance levels are tricky especially for scalpers and day traders. Sometimes, the market will fiercely break into a level and reverse back once it hunts your stop-loss.

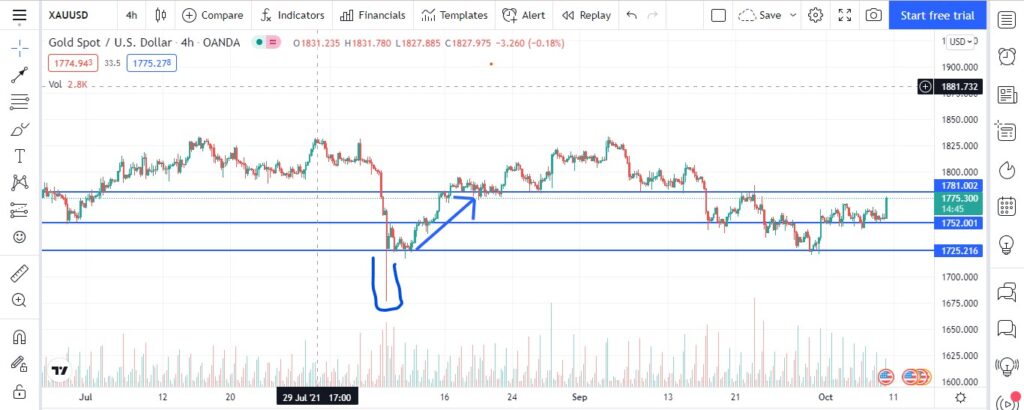

To avoid stop-loss hunting, do not place stop-loss too close to your support or resistance level. Below is an example of XAUUSD where the market broke in fiercely to hunt stop-losses and the same candle (H4) reversed back and started moving in the intended direction.

As you can see, the wick of the candlestick is almost 500 pips. Most traders would have bought from the support level with their stop-loss right below the support or some 200-300 pips below. The market brutally kicked out the majority of the retail traders and reversed back. So, what can we learn from this?

- Either wait for the perfect entry point when the market breaks in and starts hitting stop-losses. How do you know when to enter? Well, think of it this way. Suppose you wanted to buy XAUUSD from the 1725 support level, where would you put your Stop-Loss? 1690 or 1695 (considering it a weekly trade and your risk/reward ratio is 1:50 with TP set at 1775)

Now, what you can do is set a buy limit at 1690 or 1695, that is where you were going to put your stop-loss. This way, you will avoid much of the stop-loss hunting. OR, - Be a little brave with your stop-loss. If you want to miss a good entry then place your stop-loss a little farther to give room for stop-loss hunting. The drawback is that if you got your stop-loss hit, it can give you a huge loss. I recommend you use a smaller position size to avoid the setback.

Final Thoughts

Stop-hunting is everywhere. Be it Currencies, Commodities, Indices, or the stock market, the whales make money by hunting retail traders. To be a profitable trader, you should accommodate yourself with the fact that it is a real thing and you need to be cautious about it.

Patience is the key to avoiding stop-loss hunting. Be patient in activating your trades and rely on strong evidence only when it comes to trading against the trend. Furthermore, calculate your risk/reward ratio and select position size accordingly.

Removing your stop-loss is not a wise move and you can get your trading account washed on a volatile day. Therefore, always have a stop-loss but make sure to implement the above ways to reduce the risk of getting hunted. Happy Trading!

3 comments

I Really love your work, this is really a good work, I must confess. keep up the good work. Thanks.

I’m glad you liked the work, Victor. Happy Trading!

Thanks for your education.

But please l want you to be my trading mentor. So let me have your WhatsApp contact. This is my WhatsApp contact+97431597036