What Is Payback Period?

The Payback Period measures how much time a project will take to pay back the money/investment that the project requires. It considers the expected cash flows and focuses on liquidity instead of profitability.

Let me keep the bookish definition & explanation aside and simply explain what the payback period actually is.

The payback period measures the time span that a project would take to recover its initial investment. For example, if a project requires a $1000 investment and each year it is expected that the project would bring in $250 cash then the payback period is 4 years (1000/250). That means it would take the project 4 years to recover its initial investment.

Unlike profitability ratios, the payback period focuses on liquidity (cash flow) instead of paper profit which is extremely important for a business to survive and pay its bills. Thatswhy the payback period is preferred by many businesses today to solve their cash flow problems.

Simple & Discounted Payback Period

The payback period is then categorized into TWO types. Simple payback period and discounted payback period.

In the simple payback period, no consideration is given to the time value of money and is calculated by simply dividing the initial investment figure by the annual cash inflow.

Here is how to calculate the simple payback period:

Simple Payback Period = Initial Investment/Annual cash inflow

Whereas, in the discounted payback period, a discount rate is applied to the annual cash inflows to reflect the time value of money. Here’s how we can calculate the discounted payback period of a project.

Discounted Payback Period Calculation

Let us now take a step further and have a look at the advanced calculations of the payback period. Though the simple payback period is easy to calculate, the discounted payback period takes into account the time value of each cash inflow and outflow. Here’s how you can calculate the discounted payback period.

Q: A project requires a $90,000 investment and its expected annual cash inflow is $25,000. The discount rate is 8%. Calculate the payback period of the project.

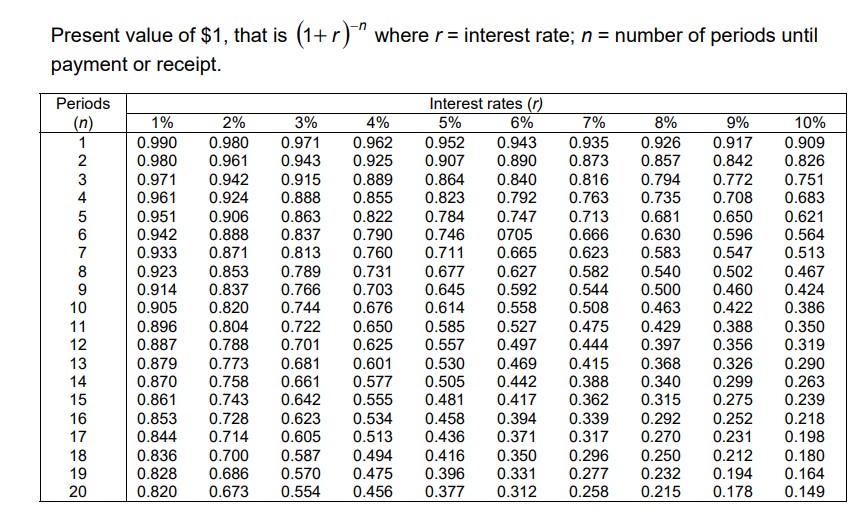

To calculate the discounted payback period, we need to multiply the cash inflow by each year’s discount rate. The discount rate could be taken from the present value table directly or you can calculate it manually using the formula (1+r)^-n.

Where,

r= discount rate in decimal form

n= number of years.

For example, the first year’s cash inflow (25,000) can be discounted as follows.

= (1+0.08)^-1 = 0.9259 0r 0.926

Alternatively, you can look up the value directly in the present value table given below.

As you can see, the first year’s discounted value for 8% is 0.926 that we calculated using the expression above. However, the present value table is normally given in exams and you can use it to derive the discounted values for different discount rates. Here’s the link to the complete Present value table.

Let us now calculate the discounted values of the cash inflows of the project.

Year1= $25,000* 0.926= $23,150

Year2= $25,000* 0.857= $21,425

Year3= $25,000* 0.794= $19,850

Year4= $25,000* 0.735= $18,375

Year5= $25,000* 0.681= $17,025

Total = $99,825

The project will recover its initial investment at the end of year 5. However, to calculate the exact payback period of the project, we need to perform a minor calculation.

At the end of year 4, the total cash inflows equal $82,800 which means we need an extra $7,200 (90,000-82800) to recover the initial investment of $90,000. Since the year 5 cash inflow is $17,025 (more than the required $7,200) we need to pro-rate the cash inflow in order to find out in how many months the $7,200 will be recovered.

Here’s how you can pro-rate it.

= 7,200/17,025*12= 5.07 months

Hence, the payback period of the project is 4 years and 5 months.

Difference Between Payback Period & ROCE

The payback period is sometimes associated with the Return on Capital Employed (ROCE). However, there is a clear difference between ROCE & Payback Period.

Return on Capital Employed is the percentage return on equity. Basically, it is used to assess the efficiency with which a company is employing its capital whereas, the payback period is used to calculate how much time it would take for an investment to recover the initial capital that has been invested in the project.

That being said, ROCE focuses on profitability in terms of the resources employed, and no consideration is given to the time value of money whereas, the payback period focuses on the time value of money, and under this system, a project with quick cash inflows is preferred.

Furthermore, the ROCE considers profitability whereas, the payback period considers cash inflows only which helps companies improve liquidity.

Why Payback Period Is Used?

The payback period is a liquidity (cash) focused technique which means that it prefers projects which are expected to recover their initial investment in the minimum time period. Here is the list of objectives of the payback period.

- Cashflow: Cashflow is the backbone of any business. There are a lot of financial ratios that talk about profitability but very few actually consider the cash flow. The payback period focuses on cash inflows instead of profitability which improves a company’s cash flow.

- It helps businesses with liquidity constraints: Companies that are under liquidity constraints prefer the payback period as the decision is based on how quickly the investment is likely to recover the capital that has been invested in the project.

For example, A company that needs short-term cash to pay its bills would prefer projects that take lesser time to recover the money laid out for the project. - Time value of money: Unlike other assessment techniques like ROCE, the payback period (Discounted Payback) takes into account the time value of money. Therefore, it is an extremely important financial measure to assess products or projects with long-term cash inflows and outflows.

Advantages & Disadvantages of Using Payback Period

The payback period has a lot of pros & cons in practical application. Here is the list of advantages & disadvantages of using the payback period.

PROS:

- Under the payback period, the company chooses projects that have the potential to recover their initial investment in a short span of time thus improving the cash flow.

- It takes into account the time value of money and hence assesses the project/product realistically.

- The payback period is easy to calculate.

- It focuses on cash inflows which are extremely important for businesses to pay their bills & expenses.

CONS:

- The discounted payback period involves advanced calculations especially if the project/project generates uneven cash inflows.

- It focuses on how quickly the project recovers its initial investment rather than looking at the whole potential of the project.

Article Sources

Payback Period And NPV (Core AC)