Probably the most discussed topic in different online forex communities is the minimum equity requirement of forex. I have heard “Forex Gurus” explaining why you shouldn’t trade with equity lesser than $10,000. I mean $10,000 takes a life to save and even if someone can afford it, why would they take the shot of risking all of it on forex assuming they are beginners!

Diclaimer: Trading Futures, Forex, CFDs, and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results. Articles and content on this website are for educational purposes only and do not constitute investment recommendations or advice.

So, let’s talk a bit about “equity” and the effects it can have on your trading style.

What Is the Minimum Equity to Start Forex?

At a glance, there’s no strict equity requirement to start Forex Trading and you can start with as low as $10. It primarily depends on the minimum deposit that your broker offers.

However, if you are someone who wants to roll the dice overnight or follow that get-rich-quick strategy that you have recently got to know about, then $10 or even $100 won’t do for you and most likely, you will blow your account!

So, how much equity should you start with? In a nutshell, the minimum forex equity depends on your trading style. If you are a patient trader and want to master tips and strategies (which I personally recommend), then merely a $50 account is enough to serve the purpose and help you become a consistently profitable trader. Once you become confident, you can take a step further and add more equity.

How to Trade Forex with Small Account?

Statistically, 80% of small traders blow up their accounts primarily due to taking excessive risks on small accounts.

Ideally, one should risk only 1 or 2% of the total equity on a single trade and it gets boring with small accounts since 1% of $50 is $0.5 and you won’t be able to catch some good pips! It is hard but it is totally doable and there are Tips & Techniques that will enable you to trade on a small account and grow your equity significantly.

Here’s how you can successfully trade forex pairs on a small account:

Tip #1 Trade with Patience

Patience is the key to becoming a successful trader and I can’t stress it enough. There’s a famous saying in the forex market that says: “don’t rush, you will get crushed!”.

While entering into a trade, don’t let your dopamine drive your decisions and consider every single aspect of the trade. It could be checking different timeframes or assessing the chart on an indicator. The point is that the market will always be there for you as long as you have equity so never be in a hurry and be a patient trader.

Tip #2 Set Realistic Targets

Statistically, more than 80% of small retail traders lose money in the Forex market and my best bet is the lack of discipline.

The thing with small accounts in forex is that you can’t afford to lose much and therefore, it is vital to plan everything carefully. To do that, you should set realistic short-term targets and attempt to grow your forex account gradually instead of attempting to double and triple it. Here’s how you can set realistic targets for a small forex account:

- Set daily or weekly target profit percentage. A realistic approach is to set it at 20%-50% weekly since it is easily attainable on small forex accounts. However, if your equity is $100+, you shouldn’t go more than 20% since it would require you to use bigger lots and there’s a fat chance that you will blow up the account.

- Try to set performance-related targets instead of sticking to profitability only. One way to do that is to take your analysis success rate to 80%. If you focus on performance, ROI will follow you.

Tip #3 Don’t Let Your Excitement Drive You

Being a Forex Trainer, I interact with lots of newbies on a regular basis. When they start explaining how they ended up blowing their previous trading account, my bet is always on the “excitement”!

It can get tricky at times. The thing is: when someone makes money for the first time merely by clicking on a buy/sell button on their phone while lying in bed peacefully, that’s when they realize how big they can go —And that’s when they are trapped.

That being said, keep your emotions aside and purely take your decisions rationally. When you make a profit, that doesn’t mean you should take unnecessary risks since you are in the blues now. Plan and take every entry on the basis of market conditions and not your account condition!

Tip #4 Revenge? Naah

When you lose your first few trades: what do you do? If you are someone who tries to recover what they just lost, you have been doing it completely wrong!!

As mentioned earlier, don’t ever involve emotions in trading. Statistically speaking, it would only result in further losses eating the whole of your small equity trading account.

Therefore, the moment you incur losses, stop for a while and effectively plan your next entry, or better, take a break and hit your next session later after an extensive self-audit.

Tip #5 Think Conservatively

CAN’T LOSE

MONEY !

It’s okay to be conservative in forex trading especially when you have a small trading account. Keep track of every penny of your trading account and don’t just take a trade for the sake of trading! You should only enter into a trade once you have checked every single detail.

If you keep losing pennies, your “OK” attitude will soon turn into losing dollars and you ultimately end up blowing your small account. Here’s how you can adopt a conservative yet healthy trading attitude for a small account in forex trading:

You can adopt the conservative trading strategy in forex by seeking the highest possible risk to reward ratio. Basically, the strategy is based on strict risk management and works best when you are looking for a high yield with low risk.

To do that, take minimal risks and only consider the trades with higher favorable indications such as demand and supply zones combined with moving average support or RSI divergence. The point is not to rely on a single indicator or strategy and always look for higher probabilities in the market.

If you follow these general tips for small accounts, you will notice significant improvements in your trading approach. To become a consistently profitable small account forex trader, here’s my collection of small account trading strategies:

Small Account Trading Strategies

Though most trading strategies work equally good for both small and big forex trading accounts, it is still not wise to use every strategy on a small account since most strategies have huge stop-loss gaps or they work on bigger timeframes only, and that’s not something that your small account can bear. Here are a few Small Account Trading Strategies:

RSI Divergence Trading Strategy

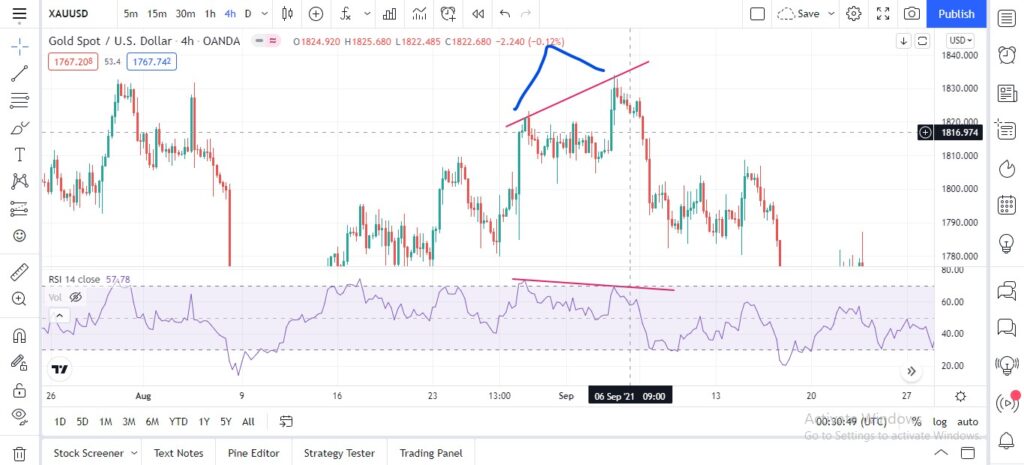

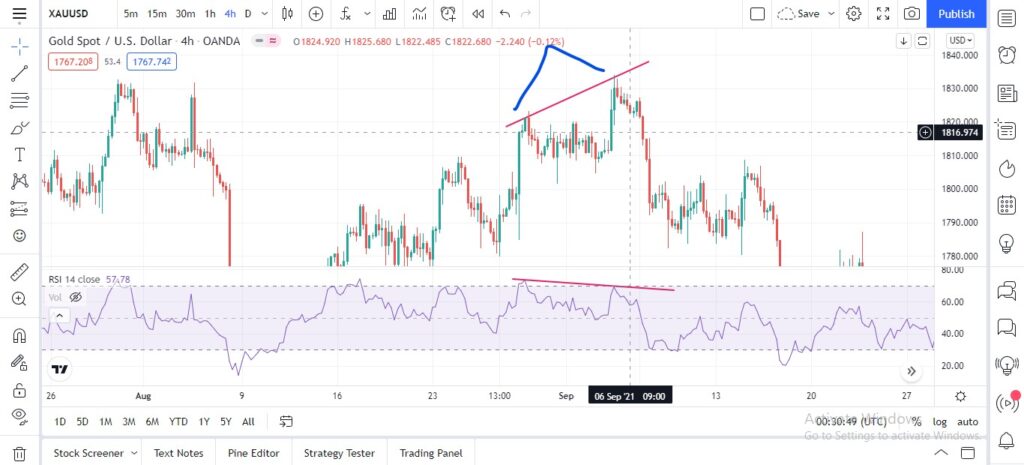

RSI Divergence is simply an event in the market when the candles form higher highs and the RSI forms lower highs, OR when the candles form lower highs and the RSI forms higher highs. In a nutshell, when the RSI of the pair and the candlesticks are in contrast with each other. Here’s how it looks on the chart:

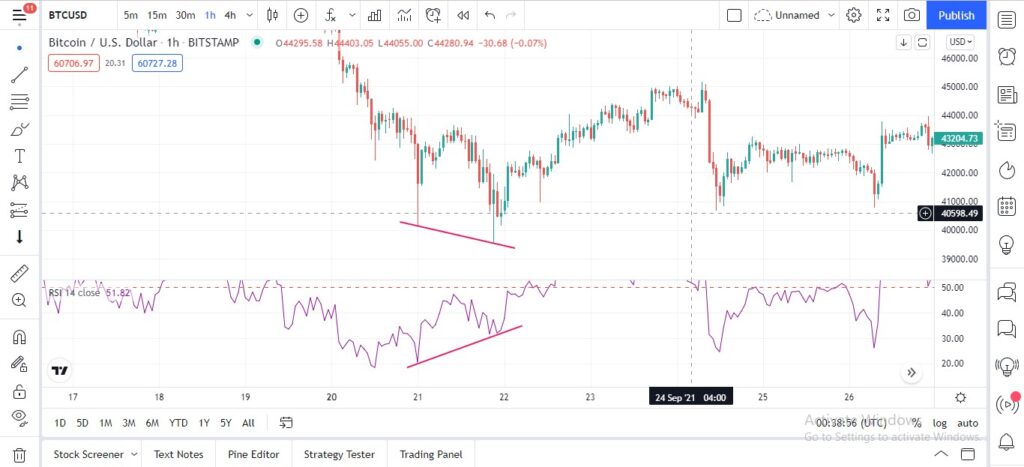

You can also identify the RSI divergence in the lower ends of the candles and RSI. Here’s how:

Now that you know what RSI divergence is, let us take a look at its potential to drive the market:

At a glance, the RSI divergence reverses the market meaning that if the market is going upwards and RSI divergence occurs, the market should start going down as per the rules of the RSI divergence strategy. Similarly, if the market is bearish and RSI divergence occurs, the market will turn bullish. Here is an example that explains the point.

As you can see, the market was bullish right before the divergence and the moment divergence occurred, it started some strong bearish moment.

Why RSI Divergence Is Good For Small Accounts?

While RSI divergence is an equally good strategy for both small and big accounts, it is specifically preferred by small account traders since it results in sudden price movement which can give you quick pips. It is important to catch small movements with small accounts with a tight stop-loss meaning that with a massive risk-to-reward ratio.

If you focus on long trades, you would need to place stop-loss accordingly and one wrong trade could cost you your whole equity.

Therefore, RSI divergence is extremely helpful for small account traders and it works pretty well at lower timeframes such as m15, m30, and h1.

The Moving Average Method

The moving average is one of the favorite indicators of almost every trader. Simple to analyze, the moving average is used to keep track of the price trend of a pair. Here’s how the moving average indicator works:

There are different variations of the moving average indicator but for small accounts, I recommend smooth moving averages of 21, 50, and 200.

To add smooth moving averages, go to indicators>add new>moving average>> “add three moving averages with periods 21, 50, and 200”. Once you have added the moving averages, go to properties and select the method “smoothed”.

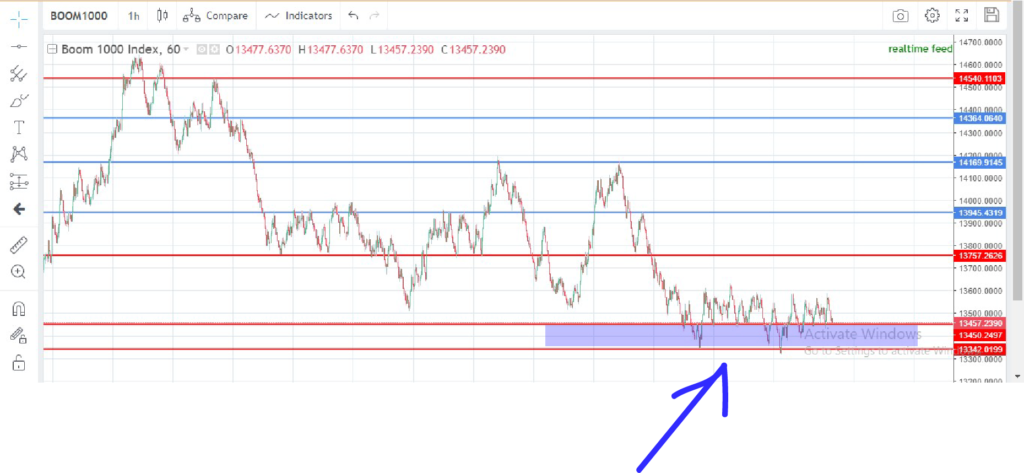

Now that you have moving averages set up, find the trend of the pair first: if the price is floating above the moving averages, it indicates that the pair is on an uptrend whereas if it’s below the moving averages, it indicates a downtrend. Now, you may observe different trends in different timeframes but for the trend, you should rely on higher timeframes only such as h1, h4, and d1. Here’s an example that explains it:

As you can see on the above Boom 1000 chart, whenever the price touches the MA21, it gets rejected and continues the uptrend. Therefore, you can catch some quick pips on your small account using the MA strategy.

If the price breaks into the MA21, your next bet is on the MA50. Here’s how:

Please note that sometimes there could be a strong price action event in the market in which case it will not follow any moving average and you cannot risk it on your small account. Therefore, you should always have a stop-loss.

Demand & Supply Zone Strategy

In trading, a Demand Zone is a level where most of the traders are willing to buy the asset whereas a Supply Zone is a level where most of the traders are willing to sell the asset.

In a nutshell, demand & supply zones are like support and resistance levels and we can expect some strong rejections from demand and supply zones. To better understand how you can grow your small forex account fast using demand and supply zones, let me first show you how to identify these levels in the market:

Demand & Supply zones work like support and resistance levels and in normal trading conditions, you can observe strong rejections from these areas. Therefore, whenever the price approaches such a level, make sure to place your order with a tight stop-loss below or above the level. Generally, you should place stop-loss some 5-20 pips away to give room for stop-loss hunting.

To know more about making the most out of this strategy, here’s my detailed article on how to effectively draw support and resistance levels.

Double Top / Double Bottom

Double Top or Double Bottom are both types of candlestick patterns in the market. A double top refers to the pattern when a resistance level restricts the market twice from breaking in whereas, in double bottoms, a support level restricts the market twice from breaking in.

In simple terms, when the candlesticks are unable to penetrate a certain price level in the market. You can catch some quick pips in double tops and double bottoms since they result in a sudden reversal. Here’s how you can trade double tops and double bottoms on a small forex account:

- Carefully observe the market on different timeframes to identify double tops and bottoms

- Once you have identified the pattern, wait for the price to retest on the support/resistance level

- Place your trade with stop-loss right above or below the support/resistance. Please note that you should give a margin of 5-10 pips to give room for fake breakouts.

These are some prominent trading strategies to grow your small account. The most important thing to remember is the “multiplier effect” aka compounding.

While trading a small account, don’t aim for big profits in the beginning. Big profits will compel you to take big risks which would (most definitely) result in blowing up your account. Instead, focus on those pennies and dollars and you will easily grow your small account to hundreds and thousands.

Article Sources